Photo by TopSphere Media on Unsplash

Leases still play a big role in car shopping: new leasing reached 24.69% of new vehicle financing in Q1 2025.

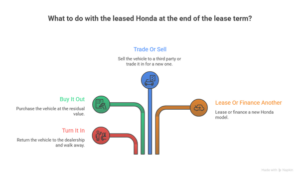

When your Honda lease hits maturity, you basically stand at a four-way intersection: return it, buy it, trade/sell it, or roll into another Honda. None of these options wins by default. Your contract numbers and your real-life needs pick the winner.

If you feel tempted to keep your current Honda, consider a Honda lease buyout and compare the buyout math to your next-best alternative.

Know Your Timeline And Key Numbers

Start with your contract, not your mood. Pull three items from your paperwork or online account:

- lease maturity date

- residual value (buyout price)

- allowed miles

Then estimate your current miles at turn-in day.

Honda Finance may apply over-mile charges if you exceed the allowance, so the difference between “close enough” and “oops” can cost real money. American Honda Finance tells customers to review the lease agreement for mileage-charge details, since the contract controls the exact amount.

Also, plan for end-of-lease fees. Many leases include a disposition fee if you return the vehicle and walk away. Many lessors charge roughly $300 to $400+, and you often avoid it if you buy the vehicle or, sometimes, if you lease another vehicle with the brand.

Finally, schedule a pre-return inspection if available. It helps you spot chargeable wear early, while fixes still cost less than a surprise bill.

Option 1: Turn It In And Walk Away

This option feels clean: you hand over keys, you take a deep breath, you move on. In practice, you still need to settle the numbers.

You may owe:

- Disposition fee (common on many leases, often a few hundred dollars).

- Excess mileage if you exceed the contracted limit. Many guides cite typical per-mile ranges around $0.10–$0.25 (your contract sets your actual rate).

- Excess wear charges if condition falls outside normal wear.

This path works best when your Honda no longer fits your life. New commute, new family needs, or you just want a clean reset.

It also works when your buyout price sits far above what similar used Hondas sell for in your area. The key move: confirm all lease-end steps and return location rules, then document the condition with photos on the return day.

Option 2: Buy It Out And Keep It

If you like your Honda and it treats you well, a buyout can feel like “promote this car from temporary to full-time.” The buyout price usually equals the residual value plus taxes and required fees. Kelley Blue Book’s leasing guide describes buyout as a standard lease-end path and explains how leasing compares with buying across cost and flexibility.

When buyout makes sense:

- You kept miles low, and the condition looks strong.

- You know the service history (because you lived it).

- Similar used Hondas cost more than your buyout total.

Watch-outs:

- Loan rate: A high APR can ruin a good buyout price.

- Total out-the-door cost: includes tax, registration, and any purchase option fees listed in your contract.

Practical tip: get a real market value estimate for your exact trim and mileage, then compare it to the buyout total. If market value beats buyout, buyout often wins.

Option 3: Trade Or Sell The Leased Honda

Yes. You can often trade or sell a leased vehicle, but rules depend on the lessor and current policies. If the vehicle appraisal beats what you owe (buyout plus any required items), you may capture equity instead of handing it back.

This option shines when:

- Your Honda holds value well (many do).

- You want a different vehicle, but you do not want to “donate” equity to the return lane.

- You can secure a strong appraisal from multiple buyers.

How it works in plain terms:

- Ask Honda Finance for a payoff or buyout quote.

- Get written appraisals from at least two sources (dealer plus a used-car buyer).

- Compare: best appraisal – payoff = equity (if positive).

If you see negative equity, you still can trade, but you should treat that shortfall like real debt, because it acts like real debt.

Option 4: Lease Or Finance Another Honda

If you plan to stay with Honda, you may avoid some end-of-lease friction.

Many leasing setups waive or reduce certain lease-end costs when you lease another vehicle with the same brand, and disposition-fee waivers often show up in brand or dealer programs (terms vary by offer and contract).

Many lessees avoid the disposition fee by buying the car or, in some cases, by leasing or purchasing another car of the same brand.

Also consider the monthly payment reality. The average monthly auto lease payment was $659 in 2025 (U.S. consumers), so a “small upgrade” can land at a bigger number than your last deal.

This option works best when:

- You want newer safety tech or warranty coverage.

- You prefer predictable costs and shorter commitment.

- Your current Honda has mileage or wear risk that may trigger charges if you return it.

Negotiate like a grown-up: focus on total cost, not just monthly payment.

Conclusion

Lease end feels like a deadline, but it’s really a choice point.

Compare buyout math, return costs, and trade equity, then pick what fits your budget and routine. If you keep the car, protect its value with a few smart habits.