In recent years, UPI (Unified Payments Interface) has transformed the way India makes digital payments. What started with linking savings and current accounts has now expanded to include credit cards. The introduction of UPI credit card payments has opened a new era of flexibility, allowing users to make transactions directly from their credit cards without swiping or entering long details.

If you’re wondering how to set up this feature, this guide will take you through everything you need to know about linking your credit card to UPI step by step.

What is a UPI Credit Card?

A UPI credit card is simply a credit card that can be linked to your UPI-enabled apps (like PhonePe, Google Pay, Paytm, or BHIM). Instead of using your bank account, your credit card becomes the funding source for UPI transactions.

This feature was launched by the Reserve Bank of India (RBI) and supported by the National Payments Corporation of India (NPCI) to encourage digital payments and provide more flexibility to users.

Currently, RuPay credit cards are widely accepted for UPI linkage, while support for Visa and Mastercard is being rolled out gradually.

Benefits of Linking a Credit Card to UPI

Before we dive into the process, let’s quickly understand the benefits of using a UPI credit card:

- Convenience – No need to carry physical cards for payments.

- Quick Payments – Scan QR codes or send money using UPI PIN directly from your credit card.

- Reward Points – Continue earning cashback, points, or rewards from your credit card provider.

- Increased Credit Usage – Provides more flexibility when your bank balance is low.

- Secure Transactions – UPI transactions are protected by PIN verification and RBI guidelines.

Step-by-Step Guide to Link Your Credit Card to UPI

Here’s how you can easily set up your UPI credit card for seamless payments:

Step 1: Choose a UPI App

First, ensure you have a UPI-enabled app installed on your smartphone. Popular options include:

- PhonePe

- Google Pay

- Paytm

- BHIM UPI

- Amazon Pay

Make sure the app you select supports credit card linkage, especially for RuPay credit cards.

Step 2: Open the App and Go to Payment Methods

Once you open the app:

- Navigate to the ‘Payment Methods’ or ‘Bank Account’ section.

- Select ‘Add New Account/Card’.

This is where you’ll add your credit card details.

Step 3: Select ‘Credit Card’ Option

Most UPI apps now provide an option to add credit cards separately. You’ll usually find:

- Add Bank Account

- Add RuPay Credit Card

- Add Debit Card (if supported)

Choose ‘Add RuPay Credit Card’ (or simply ‘Credit Card’ if available).

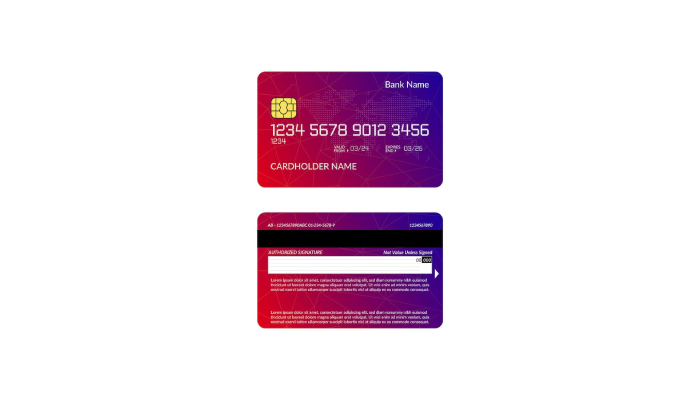

Step 4: Enter Credit Card Details

Fill in the required information:

- Credit card number

- Expiry date

- Name on the card

- CVV (if asked)

Your app may automatically fetch some details if it’s already saved.

Step 5: Verify with OTP

After entering details, the app will send an OTP (One Time Password) to your registered mobile number. Enter the OTP to authenticate.

This step confirms that you are the rightful owner of the credit card.

Step 6: Set UPI PIN for Credit Card

Next, you’ll be prompted to create a UPI PIN for your credit card (just like you do for your bank account).

This PIN will be used every time you make payments using the UPI credit card.

Step 7: Start Using Your UPI Credit Card

Once successfully linked:

- Open the UPI app.

- Select your credit card as the payment source.

- Scan QR codes, pay merchants, or shop online.

Every transaction will now be billed to your credit card account instead of your bank account.

Important Things to Know Before Linking

Here are some key points to keep in mind before using your UPI credit card:

- Availability – Currently, UPI works mostly with RuPay credit cards. Visa and Mastercard support is expanding gradually.

- Merchant Restrictions – Some merchants may not accept UPI credit card payments, especially for peer-to-peer transfers. It’s mostly allowed for merchant transactions.

- Credit Limit – Your spending is limited by your card’s credit limit.

- Rewards and Charges – Normal credit card charges, interest, and reward points policies apply.

- Security – Never share your UPI PIN with anyone. Always verify QR codes before scanning.

Conclusion

The integration of UPI credit card payments is one of the most exciting updates in India’s digital payment ecosystem. It not only makes transactions faster and more convenient but also allows you to leverage your credit card benefits without carrying the physical card everywhere.

By following the simple steps shared above, you can link your credit card to UPI and start making secure, cashless payments in minutes.

As more banks and card networks adopt this feature, the UPI credit card will soon become as common as linking your savings account. If you haven’t tried it yet, now is the perfect time to set it up and experience the ease of digital credit transactions.